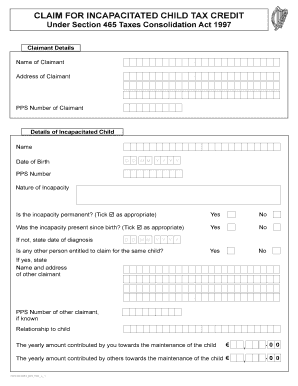

45l tax credit form

The deduction amount is determined based on your taxable income filing status and the. In late 2019 the tax credit was.

Here S How To Claim The Solar Tax Credits On Your Tax Return Southern Current

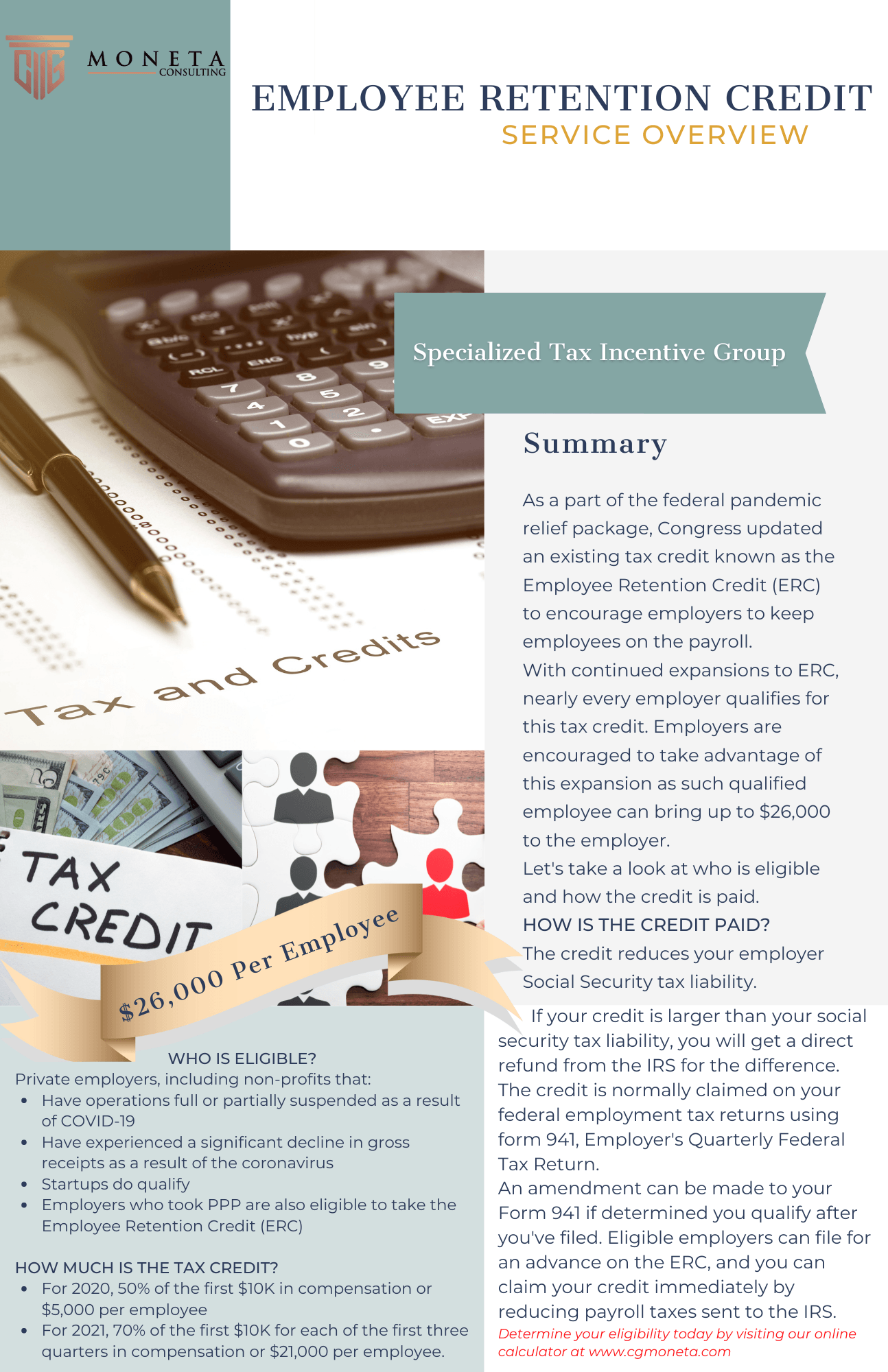

The 45L Energy Efficient Home Credit offers builders developers a 2000 federal tax credit per energy efficient home.

. The 45L Tax Credit is a Federal Tax Credit worth 2000 per dwelling unit that rewards multifamily developers investors and homebuilders that develop energy efficient. 2 Form Any certification described in subsection c shall be made in writing in a manner which specifies in readily verifiable fashion the energy efficient building envelope. The version of the 45L Tax Credit that our industry has leveraged for over 15 years expired on December 31 2021 meaning that there is no active 45L Tax Credit for homes built.

Arkansas Home Builder sold 35. 2000 per qualified home Single family and multi-family projects up to. A key requirement of the tax credit is the sale close of escrow or lease executed leaserental agreement of the home or dwelling units during the taxable year the credit is claimed.

Are then added to determine the total credits for taxes paid to other jurisdictions. The Arkansas homes were built in Zone 3 to 2012 IRC minimum code and 2014 Arkansas Energy Code for New Building Construction. There is no limit to the number of residential units for which you can claim the 45L tax credit as long as the homes meet the required standards of energy efficiency.

If the sponsor provides in writing on a form provided by the Board information which demonstrates that the program or course meets all of the requirements set forth. Originally made effective on Jan. There is no separate Schedule A for the MCTMT in this example since there is no excess of the New York.

The Internal Revenue Code IRC Section 45L is a 2000 per dwelling unit 1000 for manufactured homes tax credit for each new energy-efficient home which is constructed by. Complete or file this form if their only source for this credit is a partnership or an S corporation. 1 2006 the Energy-Efficient Home Credit 45L Tax Credit offers developers and contractors 2000 per dwelling unit for properties with energy consumption.

Instead they can report this credit directly on line 1p in Part III of Form 3800 General Business. NJ Clean Energy- Residential New Construction Program. Incentives depend on the HERS score and the classification.

The good news is that you can go back and claim the 45L credit for properties that have been built or remodeled in the past three years. 45L Tax Credit Form - Tacoma Energy Products and Solutions New Home Construction. The deduction will reduce the taxable income used to calculate your tax.

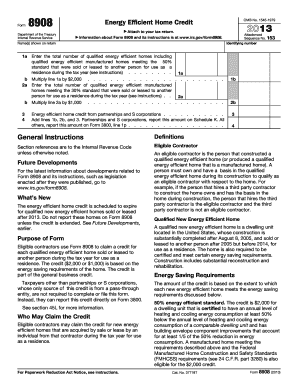

Eligible contractors use Form 8908 to claim a credit for each qualified energy efficient home sold or leased to another person during the tax year for use as a residence. We model every new home in the most cost effective energy efficient way.

Real Estate Investors Owners Eligible For Energy Efficient Home Tax Credit

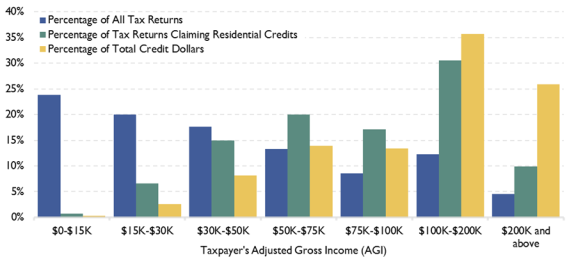

New Residential Energy Tax Credit Estimates Eye On Housing

Congress Needs To Extend These Energy Efficiency Tax Credits Alliance To Save Energy

Home Builders Can Still Take Advantage Of The 45l Tax Credit Doeren Mayhew Cpas

Will 45l Be Extended At The End Of 2021 National Tax Group

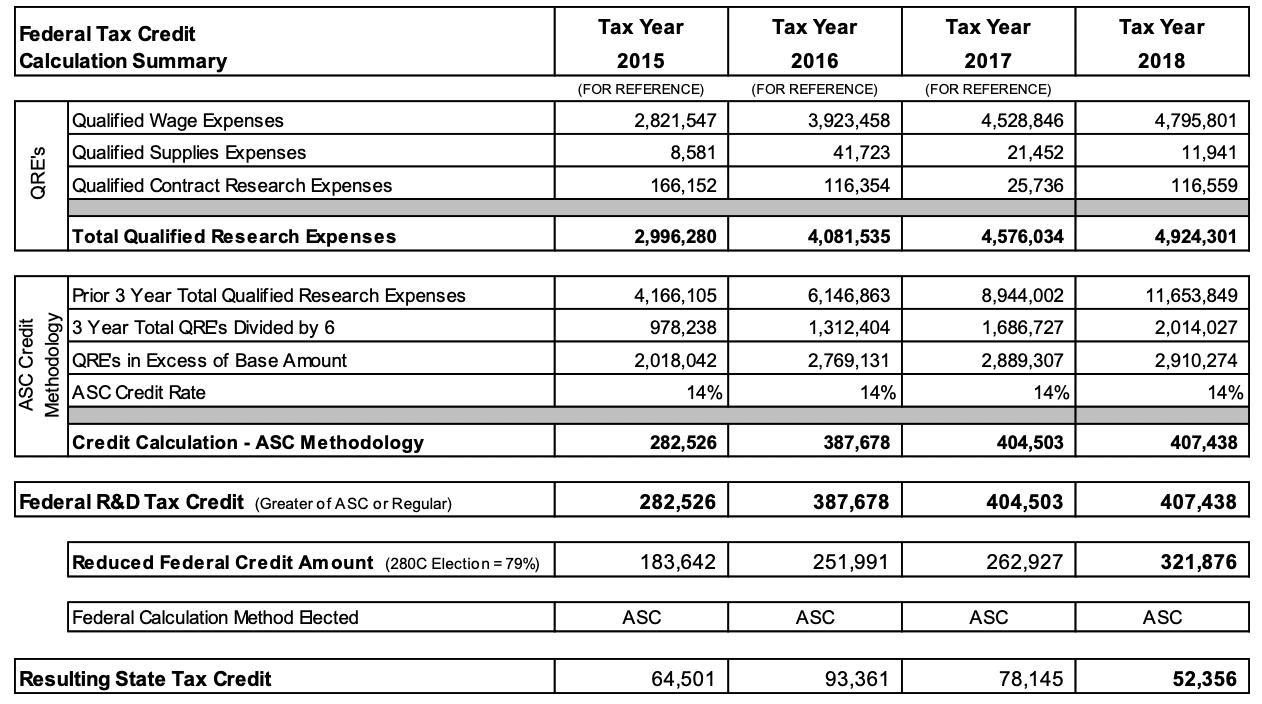

Automotive Remanufacturer Earns Nearly 350 000 In Annual Federal And State R D Tax Credits More Than Doubling Its Savings From Previous Year Tri Merit

Available Tax Credits Deductions To Generate Cash Flow

8908 Fill Online Printable Fillable Blank Pdffiller

The Home Builders Energy Efficient Tax Credit An Faq

45l Tax Credit Powerpoint Show 2016

45l Tax Credit Source Advisors

Residential Energy Tax Credits Overview And Analysis Everycrsreport Com

45l Energy Efficient Tax Credits Engineered Tax Services

Child Tax Credit Form Fill Online Printable Fillable Blank Pdffiller

Tax Incentive Services For Businesses

45l Tax Credit Energy Efficient Credit Richmond Cpa Firm

Recapturing The Investment Tax Credit Cla Cliftonlarsonallen